Car depreciation calculator tax deduction

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. You Get the Best Offer In Seconds.

Depreciation Calculator Depreciation Of An Asset Car Property

18100 First-Year Depreciation for Qualifying Models.

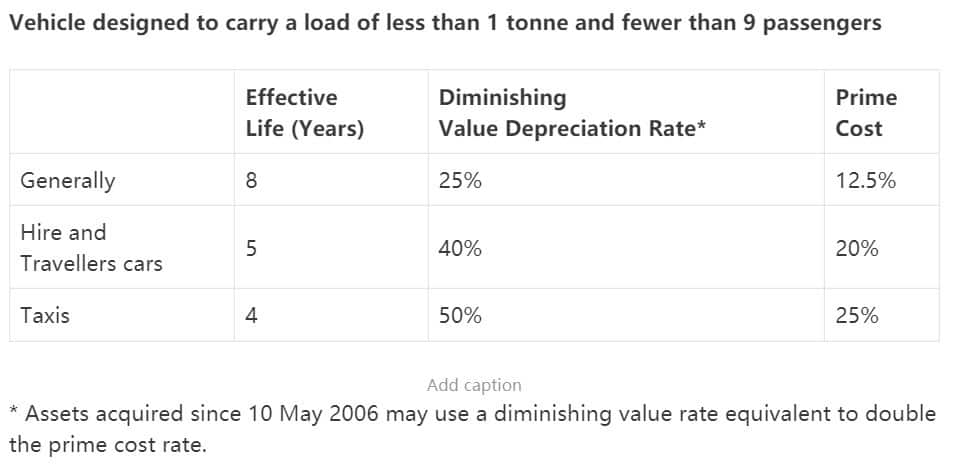

. It can be used for the 201314 to 202122 income years. So 11400 5 2280 annually. Alternatively if you use the actual cost method you may take deductions for.

You use the car for business purposes. With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. To calculate the depreciation of your car you can use two different types of formulas.

To calculate your deduction multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. It is determined based on the depreciation system GDS or ADS used.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. You need to keep records Where you. Get an Instant Offer for Your Car.

When its time to file your. Free tax filing for simple and complex returns. This includes a Nissan TITAN and TITAN XD.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2021 is 18200. Its Free 100 Online And Includes Pickup. The standard mileage rate method or the actual expense method.

We will even custom tailor the results based upon just a few of. Most calculators use data including. You can generally figure the amount of your deductible car expense by using one of two methods.

Prime Cost Method for Calculating Car Depreciation Cost of Running the Car x Days you owned 365 x. Ad Thousands of Dealers Bid on Your Car. A vehicle expense calculator helps you calculate the amount you can claim as a tax deduction for work-related car expenses for eligible vehicles.

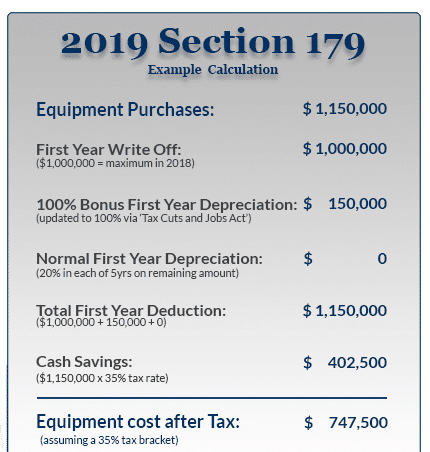

The deduction limit in 2021 is 1050000. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. Example Calculation Using the Section 179 Calculator.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Car depreciation calculator tax deduction Friday September 16 2022 66 cents per kilometre for the 201718 201617 and 201516. Subtract that depreciation from the 10000 purchase price to get 7500 - this is the written down value of the car.

Select the currency from the drop-down list optional Enter the purchase price of the vehicle. The recovery period of property is the number of years over which you recover its cost or other basis. Qualifying vehicles must have had a gross vehicle weight rating of over 6000 lbs.

7 For example lets say you spent 20000 on a new car for your business in June 2021. Guaranteed maximum tax refund. Input the current age of the vehicle - if the car is new simply.

Ad Get the 2021 tax deductions free. The next year you calculate depreciation as 25 of that written-down. Over 350 premium deductions included.

It can be used for the 201314 to 202122 income. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life.

Car Depreciation Calculate New Vehicle Depreciation

Depreciation Of Vehicles Atotaxrates Info

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Depreciation Of Vehicles Atotaxrates Info

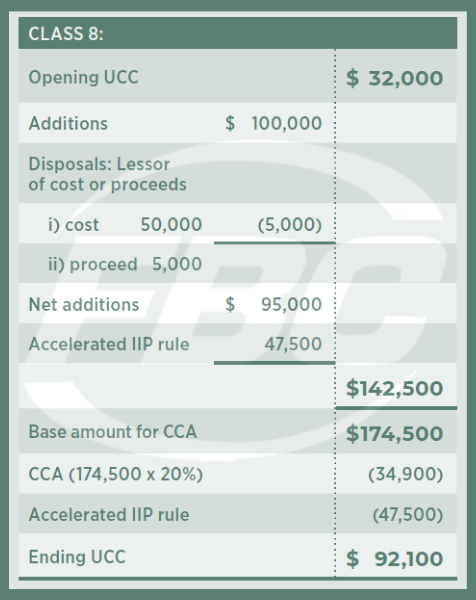

Capital Cost Allowance For Farmers Fbc

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

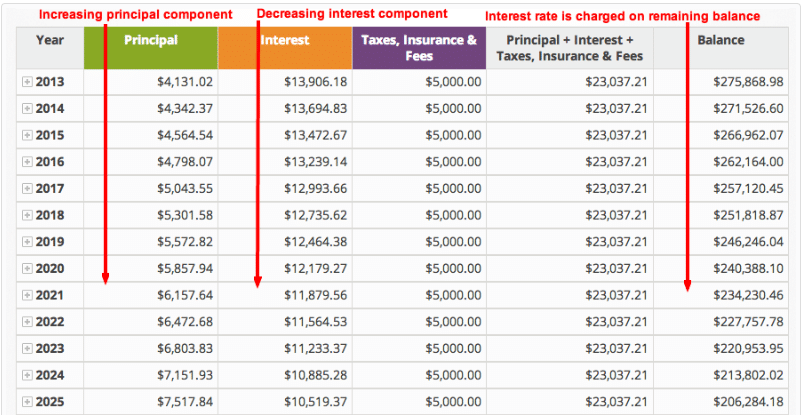

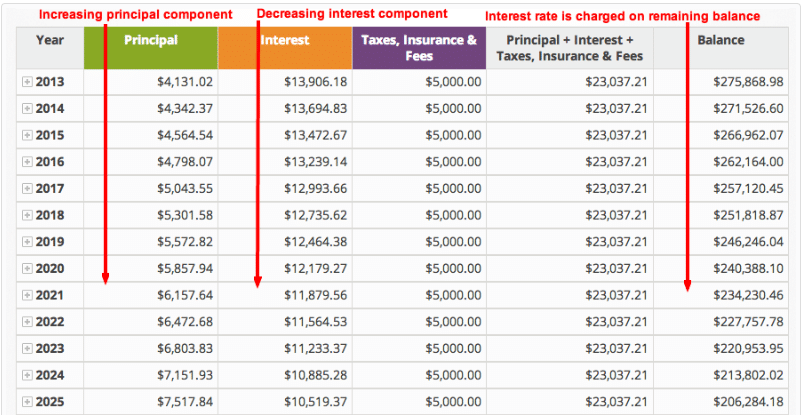

How To Calculate Amortization Expense For Tax Deductions

Depreciation Of Vehicles Atotaxrates Info

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Car Depreciation Calculator

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel